The following graphic demonstrates the Intra-Day Momentum Method (published in these articles TradingMarkets.com ) from March 19, 2015 to the most recent update (posted below) on approximately 460 stocks in the SP 500. The results are calculated at the end of the day.

Real-Time Signals

A few observations worth noting:

- Stocks that are in tight ranges have not historically closed above ML 1 or below MS 1 50% of the time (this is a majority of stocks in this list). This indicates that we will not likely have a reading of 50% or higher (Close Above ML1 / Close Below MS1) when applying the method to stocks in tight ranges.

- 'Reversals' are only counted if they closed above ML 1 or below MS 1

- Stocks that are 'Reversals', having exceeded the ML 1 Up and MS 1 Down in the same trading session are not counted in the 'Close Above Open' / 'Close Below Open' stats. Therefore, these stats 'Close Above Open / Close Below Open' are lower than actual.

- A 'Reversal' is defined as any stock that has crossed the ML 1 Up and the MS 1 Down in the same trading session

| SP 500 | ||

|---|---|---|

| Current Stats 4-1-15 to 10-09-2020 | ||

| *(Fed Meetings / Announcement Dates may not always included due to volatility) | ||

| 102314 | Close >= ML 1 | 50 % |

| 167938 | Close >= Open | 81 % |

| 206598 | Total ML 1 | |

| 208621 | Total MS 1 | |

| 164694 | Close <= Open | 79 % |

| 98833 | Close <= MS1 | 47 % |

| 51740 | ML 1 Reversals | 25 % |

| 51740 | MS 1 Reversals | 25 % |

| Total Reversals | 14 % | |

| These numbers are calculated EOD | ||

The Intra-Day Reversal

In the articles written for TradingMarkets.com, it was published that the Reversal (ML1 and MS1 being reached in the same trading session) occurred approximately 20% of the time. During the past two months, the percentage (%) of Reversals has actually been 13%. There were 6 days out of 44 that the Reversal percentage (%) was 20% or greater. The largest being 26% on May 5th. There were 16 days out of the 44 where the percentage (%) of Reversals was less than 10%. The lowest being 4% which occured on March 19. The normal range for this time period appears to be 13-16% of the time, there is an Intra-Day Reversal. This is applicable to all stocks in the list of 460, no discretion is made concerning the range.

Reversals tend to be higher when markets have fairly large differences in the Opening Price from the Previous Day's Close. In other words, Gap Openings tend to bring about more uncertainty about market direction. Reversals often come from 'Fast Moves' as well. Identifying 'Fast Moves' will be included in the scope of future web-based application development.

Real-Time Web-based Intra-Day Momentum Levels Tracking Application

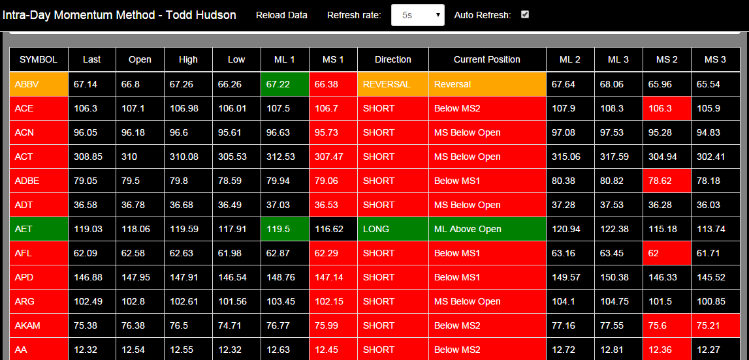

A web-based application has been developed to track and calculate the levels in Real-Time. This application was designed to so that only the stocks meeting any level appear in the view-able area. This application allows the viewer to see what stocks have met the Levels and where they currently are in relation to the levels. This web-based application applies the method to approximately 460 stocks from the SP 500.

The application color-codes the Symbol, Direction, and Current Position to indicate Intra-Day Direction and / or the current location of the stock / market. If a stock / market has reached an extended level, that level is also high-lighted to indicate the extended level had been reached. This application is currently designed to be listed in alphabetical order for demonstration purposes. In future applications, the possibility will exist to list the stocks / markets in order of time that a level was reached. This web-based application is a limited demonstration of the possibilities when different technologies can communicate effectively.

Historical Results - Calendar UNDER CONSTRUCTION Results available upon request - We are currently building an application to acccess the data.

Real-Time Signals

View the Intra-Day Momentum Method in Real-Time, using a Proprietary web-based application that signals when stocks have crossed the levels.

View details »Automated Stat Recording

Custom Programming Empowers the Researcher / Trader to design / develop intra-day approaches on their own.